Keys to de-stressing a mortgage

“Don’t sail out farther than you can row back.” This Danish saying is sound advice for anyone with a mortgage or other debts, particularly now that interest rates are rising and house prices softening.

Most Australians have a tendency to be over-confident in our ability to repay loans. We also underestimate the likelihood of things that can wrong in our lives.

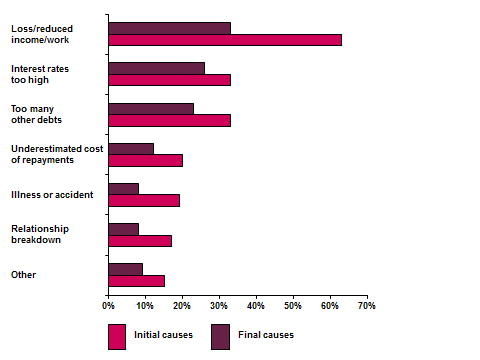

Causes of mortgage stress

Royal Melbourne Institute of Technology (RMIT) completed a study, which looked at the specific triggers that have resulted in Australian households being unable to meet their mortgage repayments. Survey respondents were asked the initial causes and, if they changed, what the final causes were. They were also able to identify more than one cause. The graph below shows the results.

How to reduce stress

Like most things in life, it’s difficult to make borrowing a stress-free exercise, but there are a few things you can do to reduce the angst.

Don’t borrow the maximum amount

Most financial institutions determine the maximum loan they will provide based on a multiple of your income and other factors. But if you borrow the maximum amount, you may find you are stretched from day one unless you are very disciplined with your budgeting.

Build up a buffer

It’s a good idea to hold (or build up) a cash reserve in a mortgage offset account to provide a buffer that can be drawn upon to meet your loan repayments if you become ill or are off work for other reasons.

Take out personal insurances

While mortgage protection insurance can provide peace of mind for a limited time frame, other types of insurances should be considered. These include:

- Income Protection Insurance which can replace up to 75% of your income if you are unable to work due to illness or injury. This can ensure you are able to continue meeting the majority of your living expenses, not just your loan repayments.

- Critical Illness Insurance which can help you service or pay off your loan and meet a range of expenses in the event you suffer a specified illness, such as cancer or a heart attack.

- Total and Permanent Disability Insurance which can help you service or pay off your loan and provide an ongoing income if you become totally and permanently disabled.

- Life Insurance which can be used to service or pay off your loan and provide your family with an ongoing income if you pass away.

Fix the interest rate

Fixing the interest rate on your home loan can provide protection against rising interest rates. The downside is there are often restrictions on making additional payments into a fixed rate loan, which would limit your capacity to build up a buffer. Many people find a combination of fixed and variable rate loans works best, as additional repayments can be made into the variable rate portion of the debt.

Don’t add fuel to the fire

Over 40% of the people who completed the RMIT survey responded to the initial difficulty in meeting mortgage repayments by using credit cards more often than they normally would. Using debt to service debt is very likely to compound the problem.

Seek advice

Before you take the plunge to purchase a property speak to an adviser who can help you assess your budget and determine your affordability level. They can help you to focus on other goals you may want to achieve in the short, medium and long term and the cash flow that may be required to meet them. An adviser can also assess your insurance needs and advise you on a range of other financial matters.

DISCLAIMER:

This is intended to be general advice only. Goldsborough Financial Services has not taken into account the objectives, financial circumstances or investment needs of any particular person. For specific advice on your situation please contact your Goldsborough Financial Planner.