In recent months I’ve spoken with clients extensively about the role the RBA has to play in controlling rising inflation. Prior to the Ukraine invasion, the largest contributor to inflation was rising house prices and the second largest (which now tops that list) was fuel prices.

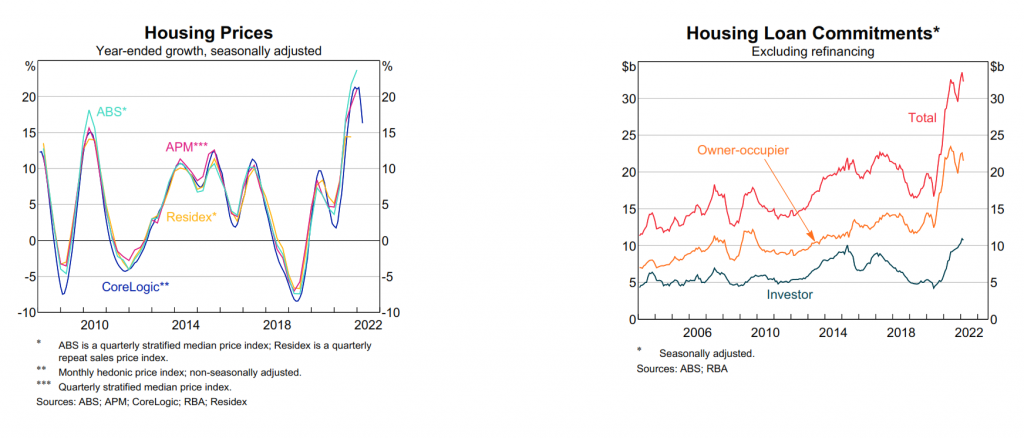

In recent months I’ve spoken with clients extensively about the role the RBA has to play in controlling rising inflation. Prior to the Ukraine invasion, the largest contributor to inflation was rising house prices and the second largest (which now tops that list) was fuel prices. The RBA’s leverage on slowing our house prices is much greater than their influence on global fuel prices, so it’s understandable that they had to move on interest rates in a bid to slow house price growth. Initial reports suggest that house buyers, particularly in the eastern states have not needed to pay an “X factor” premium to just secure a home, thus there has been some slowing of price growth.

Interestingly, the RBA’s latest numbers show that in March, even after the talk of rising interest rates and uncertainty of the Ukraine invasion, investors continued to take out housing loans at record rates. In fact, the only loan type (by $) that investors didn’t increase month on month was construction loans. Owner occupiers still have record levels of indebtedness for the quarter but based on the monthly new loan numbers, the threat (now reality) of interest rates rising seems to have taken effect.

As a homeowner and property investor, I welcome the market stabilising as the property price trajectory has simply been unsustainable. I’d suggest the numbers showing investor housing loan enthusiasm reflect that investors (who haven’t had a look in for some time) have finally seen their chance to get into the housing property market. However, investors shouldn’t pay for housing at any cost and assuming some allowance for rising interest rates, if the numbers simply don’t add up then there are other asset classes to consider…

For those financial market tragics like me, next month’s RBA Chart Data release will be one to watch!