For advisers, having accurate information is vital to providing good advice.

Your adviser may ask you to provide details of any previous super contributions you’ve made, before they can make any recommendations to add more. The easiest way to find this information out is through the ATO service on your myGov portal.

You can usually gain access to this information in a few quick steps.

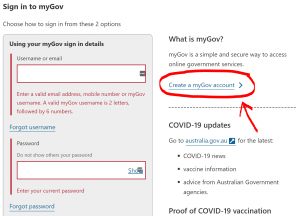

Step 1. Create a myGov account via my.gov.au

Agree to the terms and conditions, enter your email address and press ‘Next’. You will then be emailed a code to enter in the next screen.

Enter your mobile phone number and click ‘Next’ (note, each time you log in to myGov, you will be texted a one time access code to this number, to enable you to enter the portal).

You will then be required to create a password of at least 7 characters, including one number.

Lastly, you will need to create 3 secret questions in case you get locked out of your account in future.

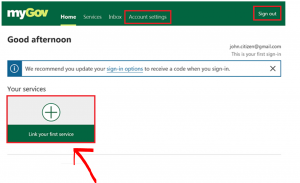

Step 2: Once your myGov account is created, you can link services such as Medicare, Centrelink or the ATO.

To link to the ATO’s online services, select the Services tab on the myGov home page. Under the heading ‘Link a service’ select Australian Taxation Office.

Select questions specific to you and answer 2 questions about information relevant to your tax record.

Most people can link online using information from their tax record. If you can’t, select the option ‘Use a linking code’ and then phone the ATO’s helpline 13 28 61 to get a unique linking code.

Once your ATO account is linked through myGov you can access it at any time to view previous tax returns, lodge your tax returns and view important information about your superannuation contribution caps.

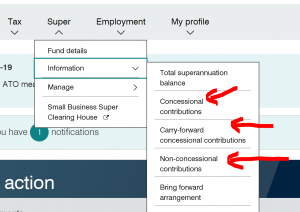

To view your super contribution information, go to the super tab and then ‘Information’.

The concessional contributions option shows what before tax contributions have been made for the current (or previous) financial years and therefore, what your remaining cap is. This includes employer super guarantee amounts as well as any contributions you may have claimed a tax deduction for.

The carry-forward concessional contributions option allows you to see if you are able to make a before tax concessional contribution to super over and above the annual cap (currently $27,500), if you have ‘unused’ contributions from the previous five financial years.

Lastly, the non-concessional contribution option shows what after tax contributions have been made to super. Again, this is important for us to know when recommending using your after-tax dollars to top up your super or to implement recontribution strategies as there is an annual cap of $110,000 (or $330,000 over 3 financial years).

If you can, we would suggest bringing your log in details to your meeting with your adviser, so we can then review these figures and provide recommendations with confidence.