How much money do you need to retire? It’s a question most Australians ask themselves at some stage. You may have heard you need $1 million – a figure that’s often mentioned.

The truth is there’s no one-size-fits-all amount. A comfortable retirement will look different for everyone. The amount of money you will need when you retire depends on many factors, including:

- The lifestyle you want

Think about how you plan to spend your money in retirement. If you own your own home and are debt-free, a general rule of thumb, is that you will need two-thirds (67%) of your pre-retirement income to maintain your current standard of living in retirement.

With this in mind, it’s important to have a “retirement budget.” There are many budgeting tools available on-line. The following link is useful: https://moneysmart.gov.au/budgeting/budget-planner

- The major costs that might be part of your retirement plans

- paying off your mortgage

- home renovations

- travel – both within and outside Australia (how often and for how long)

- new car/caravan/boat etc

- medical costs

- rent – if you are not a homeowner

- How long you need your money to last

Most people can now expect to live well into their eighties. This means that if you stop working at 65, you will need retirement income for 20 years or more.

So why are we all so worried about not having enough?

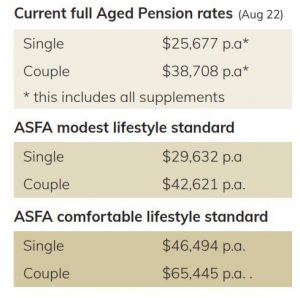

The Australian Super Fund Association (ASFA), which is the peak body in this country on all things super, has “solved” this problem by objectively outlining the annual budget needed by the average Australian to fund either a modest or comfortable standard of living in their post-work years.

A modest retirement lifestyle is considered better than the Age Pension, however, it still only allows for the basics. For example, very basic private health insurance, an occasional trip to the cinema or restaurants and only an annual domestic holiday (no overseas trips).

A comfortable retirement lifestyle allows for a broad range of leisure and recreational activities, full private health insurance, a modern car, good clothes, a range of electronic equipment, as well as domestic (and some) international travel.

The current full Aged Pension rates (August 2022) are:

The approximate savings/super amount required at retirement for a modest lifestyle for either a single or couple is $70,000, given that most of the income is via the Aged Pension.

The approximate savings/super amount required at retirement for a comfortable lifestyle for a single is $545,000 and for a couple is $640,000.

The Aged Pension is updated twice a year with CPI (usually in March and September). The ASFA figures above, are updated quarterly. All figures above assume that the retirees own their own home outright. The approximate savings/super figures detailed above, assume an inflation rate of 2.75% p.a. and an investment earning rate of 6% p.a. (Source: ASFA Retirement Standard)

Rival Opinion

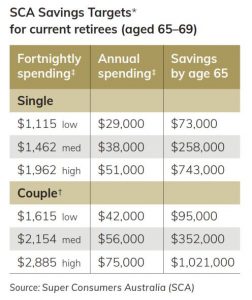

There is a new contender defining the approximate savings/super amounts, as well as the income levels needed in retirement. Super Consumers Australia (SCA), aim “to counter the established industry lobby groups.” They claim that the ASFA numbers are too high, due to a vested interest campaign for more super.

SCA was established a few years ago with money docked from the big banks for bad behaviour. Recently, it released its first “rule of thumb” estimates of the true dollar figures workers at certain ages need to accumulate in super to secure adequate income in retirement:

The figures are based on analysis of the actual spending levels of retiree households today and range from a “low” spending level of $29,000 a year for a single person (requiring a super balance of just $73,000) to a “high” spending level of $51,000 a year (requiring a super balance of $743,000).

So, in conclusion, how much do you need to save for retirement?

The simple answer is – it depends on a variety of factors, however, for many people, industry experts suggest that the million-dollar retirement number is a myth.

Boris Pedisic CFP®

Authorised Representative (No 301739)