These are common questions we hear from clients about to retire or already retired – regardless of how much wealth they’ve accumulated.

With all the mixed messages in the media and the complicated rules around superannuation, retirement incomes and tax, managing wealth in retirement can feel overwhelming. Ensuring you live the retirement you deserve, takes careful planning – you need a budget and some goals!

You often hear dire warnings that people don’t have enough saved for retirement. However, many Retirees tend to overestimate how much they need, as they don’t have work-related expenses. Also, generally, they have more time to do things for themselves. Many Retirees benefit from discounts on council rates, electricity, medicines etc. Some retirees may also receive a (part) Aged Pension.

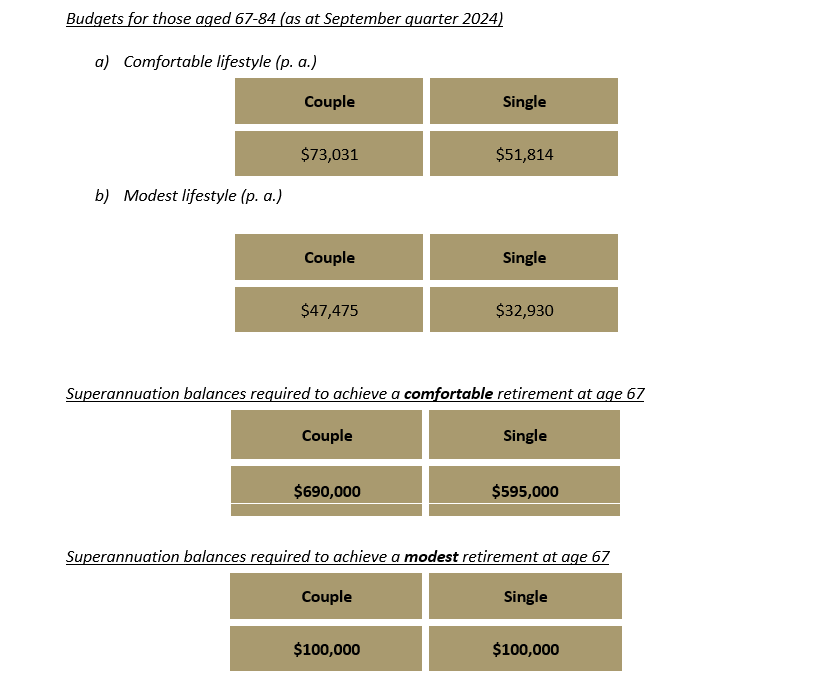

Since 2004, the ASFA Retirement Standard has provided a breakdown of expenses for a comfortable and modest retirement lifestyle, as well as the estimated superannuation balance required to achieve this. The figures detailed below assume you own your own home, debt-free.

Source: ASFA Retirement Standard

We are here to help make sure your retirement is enjoyable, stress-free and affordable. We can help you work out your required “retirement budget” and how long your money will last.

If you would like further information, please call me on (08) 8378 4000.