Global bond markets have suffered significant losses since last year’s peak, as central banks worldwide tighten monetary policy to combat rising inflation.

We don’t normally associate bond funds with negative returns but many of these investments are currently showing negative returns for the past 6-months.

In Australia and elsewhere in the world, inflation has been rising. Inflation eats away at the purchasing power of cash. Inflation was a major economic issue in the 1980s and 90’s. In the early 1990’s, the Reserve Bank of Australia (RBA) introduced a target inflation rate of 2-3% and it has been successful in keeping inflation within this band since. The current inflationary pressure has seen the RBA raise the cash rate to 0.35% in May; and possibly higher in coming months. The US Federal Reserve increased US interest rates in March for the first time since 2018.

I’ve commented before that people find the language around bonds confusing. This is because we have become accustomed to the language of the share market where rising prices are a good thing. Bond markets have been experiencing rising yields. In bond markets, the price of bonds is the opposite to the yield. So, the expectation of rising interest rates, leads to rising bond yields and hence falling bond prices.

Repricing in bond markets is an ongoing process. The difference this time is the speed which the market has had to adjust to the change in the interest rate outlook. The question of whether we will see bond yields continue to rise, will depend upon how aggressively reserve banks around the world raise rates. The consolation for fixed interest investors in the longer term is the higher interest rates from bonds, term deposits and other interest-bearing investments.

So, how bad has it been?

The graph below shows the falling price of bonds since the start of 2022. The Bloomberg AusBond Composite is a benchmark for Australian Bonds and the Bloomberg Global Aggregate is an index for the global market more broadly.

How has this affected fixed interest funds?

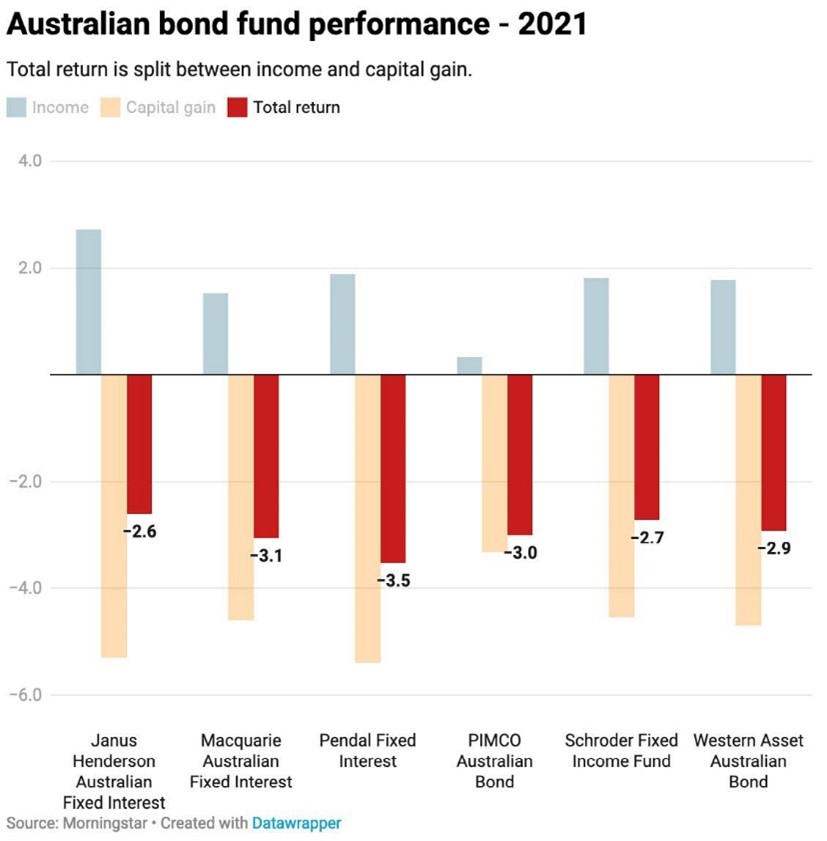

The graph below shows the return from a selection of Australian Bond funds during calendar year 2021. Note the income return remains positive but it is the capital value that has fallen. The portfolio objectives of these funds vary, and performance of these funds does not represent an investment recommendation. Data is provided by Morningstar.

The role of bonds in a balanced portfolio?

Fixed interest investments will continue to be a critical part of a well-diversified portfolio. A key investment characteristic of bonds is that on average, they tend to go up when share markets go down. This is likely to continue to be the case in future and in the event of an economic recession, bonds are likely to provide a buffer against falling share markets.

Lachlan Harvey CFP®

Authorised Representative (No 227293)